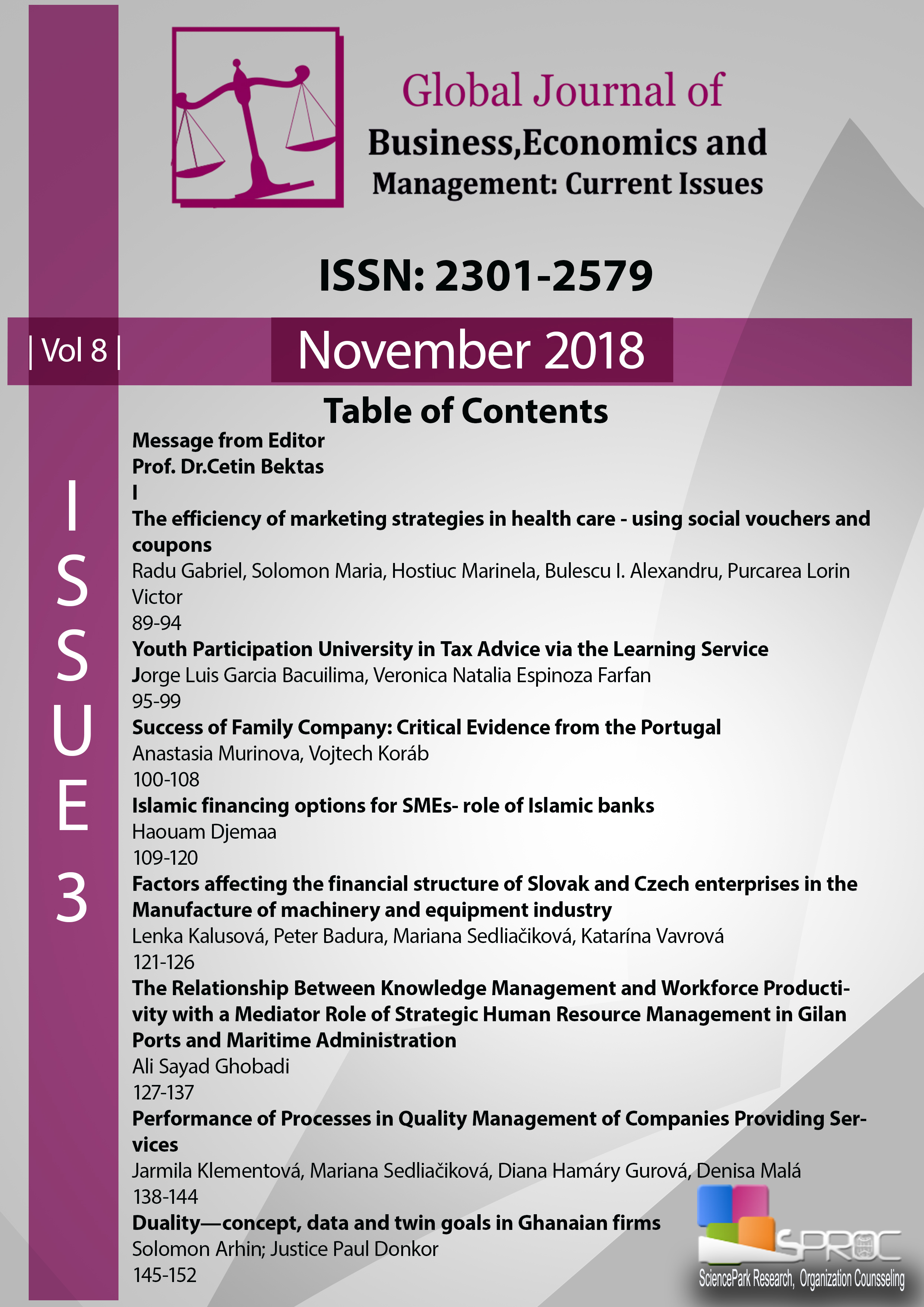

Islamic financing options for SMEs- role of Islamic banks

Main Article Content

Abstract

Small Medium Enterprises (SMEs) have significant role in employment creation and growth of gross domestic products of developing country. In developing countries, they represent the majority of employment. SMEs constitute the overwhelming majority of firms. Globally, SMEs make up over 95% of all firms, account for approximately 50% of GDP and 60%–70% of total employment. However, in order to grow and contribute more significantly to the economy, SMEs face some constraints. One of the main constraints faced by SMEs is the lack of finance. Islamic bank financing products may help to solve this problem. The Islamic participatory schemes, such as mudarabah and musyarakah, integrate assets of lender and borrowers; therefore, they allow Islamic banks to lend on a longer-term basis to projects with higher risk-return profiles and, thus, to support economic growth.However, as Islamic banks try to avoid uncertainties, the mentioned schemes are not widely used. Therefore, support from government and academia needed to create innovation in the participatory financing scheme so that all related parties can share mutual benefits. The purpose of this paper is to investigate the main challenges to Islamic finance for SMEs. This paper will help to deepen understanding of the concepts of Islamic finance as well as SMEs. In addition to evaluate how Islamic financial institutions can support SMEs.

Keywords: Islamic Finance,Islamic Banks, Small and Medium Enterprises

Downloads

Article Details

The Global Journal of Business Economics and Management: Current Issues is an open-access journal. The copyright holder is the author or authors. Licensee: Birlesik Dunya Yenilik Arastirma ve Yayincilik Merkezi, North Nicosia, Cyprus. All articles can be downloaded free of charge. Articles published in the Journal are Open-Access articles distributed under the CC-BY license [Attribution 4.0 International (CC BY 4.0)].